Good Options of Trading Platforms

Jan 26, 2024 By Triston Martin

Between 2020 and 2021, when individuals worldwide dealt with unprecedented pandemic limitations, work-life norms were flipped on their heads.

However, in 2022, the tide changed due to a new regime of more restrictive monetary policies, and investors learned the hard way that stock prices might fall just as quickly as they can soar. To aid investors in selecting the platform that best meets their needs, we compare and contrast several of the top online brokers for trading options.

The superb options analysis tools produced by Interactive Brokers are also available on the company's mobile app. In order to select the strategy with the most favourable risk/reward ratio, users can use the options spread templates provided by these tools. In addition to displaying key options Greeks on the quotation page and enabling fine-tuning of strategies via the adjustment of filters, IBKR Mobile also features one-tap options strategies, which allow the trader to easily make changes to various legs of the strategy.

Overview

In 2017, tastytrade introduced Tastyworks, an app designed by the same team that made TD Ameritrade's stellar thinkorswim® platform. The idea behind the company's inception was to give individual investors easy access to markets and high-quality analysis tools in a user-friendly environment. Tastyworks is focused solely on stock, ETF, option, and cryptocurrency trading and is thus better suited to more active investors and traders.

Tastyworks' option trading fees are among the lowest in the industry. Although there is a $1.00 per contract opening cost for each leg of an options transaction, there is a maximum fee of $10 per leg for every option deal. Clearing fees amount to $0.10 per contract. Unlike most brokers, closing positions at tastyworks does not incur a commission fee. As opposed to many brokers, tastyworks limits its options trading fees to a flat rate rather than a percentage of the total value of the trade.

Opening and closing a 50-lot vertical call spread (involving 200 contracts in total) would only set you back $40 at tastyworks, thanks to the exchange's maximum $10 per-leg limit ($20) and its $0.10 per-200-contract clearing charge ($20). Using E*TRADE's $0.50 fee per contract for higher volume/frequency traders, the same trade would cost $100. Costs for a 100-contract vertical spread trade at tastyworks would be $60 ($20 for the two legs and $40 in clearing fees), while the same trade at E*TRADE would cost $200. Tastyworks' prices are competitive for options traders, especially for high-volume, high-frequency traders.

Investors who trade less frequently pay more commissions

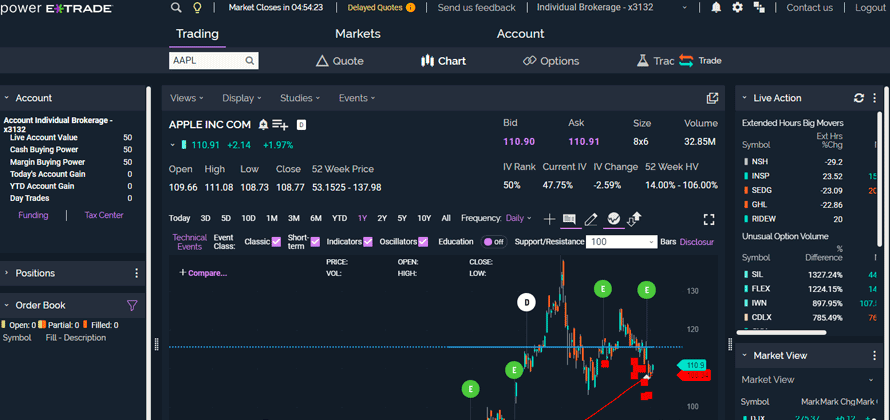

lacks support for foreign exchange, currency exchange, or digital currency despite having higher fees than other online brokers specialising in the options trading space, we found that E*TRADE's powerful desktop, web, and mobile platforms were easy to use and met the needs of both novice and experienced investors and traders, making it our Best Broker for Beginning Options Traders. One of the earliest online brokers, E*TRADE, was founded in the 1980s and was acquired by Morgan Stanley in 2020.

If you're new to trading options, E*TRADE has many resources to help you get started, including in-depth guides, interactive tutorials, and more. E*TRADE's paper trading feature is handy for novice options traders because it allows them to experiment with different options strategies without risking any real money

E*TRADE can compete with many of the top full-service brokerages across a wider variety of asset classes is just one more reason to consider it. E*TRADE's services include options trading, real-time quotes, news, fundamental market analysis, and numerous screeners for stocks, ETFs, mutual funds, and fixed income. While E*TRADE may not be the best choice for high-volume, high-frequency options traders due to its fees, it is ideal for those with more traditional stock, fund, and bond portfolios interested in branching into options trading.

Webull Is the Best Low-Priced Options Trading Broker

No commission is charged for buying and selling stocks, options, and ETFs. Webull launched in 2017 and, in 2018, introduced a mobile brokerage platform. In 2021, Webull enabled fractional shares trading, and in 2022, it eliminated commissions for trading OTC stock.

With Webull, investors can only trade equities, ETFs, options, and cryptocurrency. Webull provides its users with several helpful features, such as real-time quoting, news, and technical and fundamental analysis, without charging commissions or fees on these assets. Market calendars and a visual summary of analyst ratings from different sources are two other features that make Webull stand out. Mutual funds and fixed-income trading are not available on the platform.

Both the desktop and mobile versions of Webull are intuitive. You can save a filtered screen as a watchlist and reuse it in the future with Webull's stock screener. Webull's charts have recently been improved. The platform now includes tools for building the most typical one-, two-, and four-legged options strategies such as vertical spreads, calendar spreads, straddles, butterflies, and condors.

-

Taxes Jan 12, 2024

Taxes Jan 12, 2024Situations for Paying Taxes on Lottery Winnings

While it is true that the chances of winning the Powerball lottery are very long, someone will always be successful in beating those odds. In addition, they will be required to make tax payments on their earnings.

-

Know-how Nov 28, 2023

Know-how Nov 28, 2023Flexible Fuel Vehicles

Flexible fuel vehicles, often known as FFVs, are automobiles that can operate on either regular gasoline or a mixture of gasoline and ethanol that contains as much as 85 percent ethanol.

-

Mortgages May 19, 2024

Mortgages May 19, 2024Understanding Marketing Strategy and Its Importance

Learn about a marketing strategy, how it operates, and the best way to put it into action for your business's success.

-

Know-how Jan 12, 2024

Know-how Jan 12, 2024A Financial Advisor: What Do They Do?

The decision to pursue a career as a financial adviser may be gratifying since these professionals assist individuals in putting money away for the future and making intelligent investment decisions. To become one, you will first need to look for a company that will hire you, then you will need to become licensed, and finally, you will need to start accumulating a clientele.