Understanding Budgets

May 20, 2024 By Susan Kelly

Budgeting is the main aspect of good money management. A budget acts like a plan for your money, showing what you think will be your income and expenses in an outlined time frame. This lets you control and manage where your funds go by planning how to distribute them. The basics of budgeting and its importance in reaching financial goals will be discussed in this article.

Defining a Budget

A budget is like a roadmap for your money. It's about figuring out how much you expect to earn and spend, so you can make decisions on where to put those funds. When you set up a budget, it helps create clear rules for spending and saving which are very important in maintaining financial steadiness.

A budget is like a map that shows the way to your money journey. It decides where you can spend, but it also helps evaluate how financially healthy you are. When you manage your money with budgeting, this gives an understanding of spending habits and helps in making good choices on what things should be focused on.

- Regular Review: Regularly reviewing your budget ensures its effectiveness and relevance to your financial situation. Update your budget as needed to reflect changes in income, expenses, or financial goals.

- Emergency Fund Allocation: Include provisions in your budget for building and maintaining an emergency fund to cover unexpected expenses or financial setbacks. Building this safety net provides peace of mind and financial security.

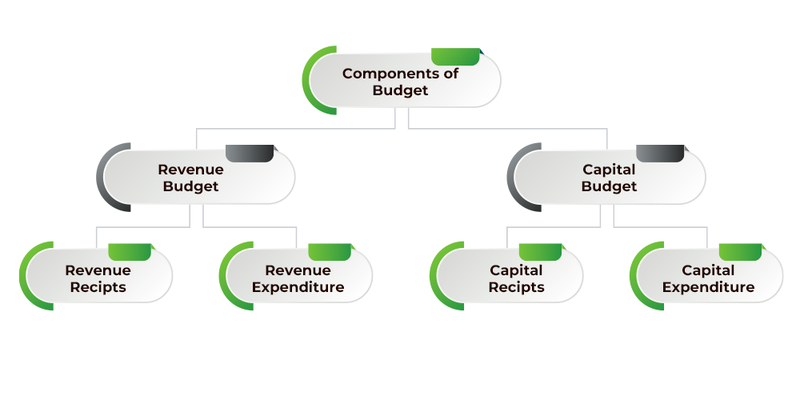

Components of a Budget

In a regular budget, there are many parts. The first part is the income section that shows all of your money coming into the house from different places like salary or wages and any other earnings too. The other side of this is expenses which include every single thing you spend on such as bills, food items, debts being paid off along discretionary purchases made by you.

You have understood the basic concept of budgeting and know that it involves managing your income compared to spending. But, there are other things to think about in a budget too. Savings: Saving money is an essential part of planning for the future financially. If you put aside some part of your income as savings, it helps in building wealth over time and getting ready for upcoming financial goals. Moreover, the budget sections can change based on personal situations. For example, some people may have more expenses in categories like housing costs or transportation while others might spend a lot on healthcare needs.

- Tracking Tools: Utilize budgeting tools or apps to track your income and expenses automatically. These tools provide insights into your spending habits and help you stay on track with your financial goals.

- Emergency Fund Priority: Ensure that building and maintaining an emergency fund is a top priority within your budget. Aim to set aside at least three to six months' worth of living expenses to cover unexpected costs or financial emergencies.

Purpose of Budgeting

Budgeting has two important parts in managing personal finance. First, it assists you in arranging spending according to importance. This means that basic needs get covered before money goes towards wants or optional items. Second, budgeting helps with saving for upcoming goals such as purchasing a home, going on holiday, and creating an emergency fund. You can track your expenses compared to your earnings. This helps identify places where you might be spending too much, allowing for adjustments in those areas.

Plus, budgeting creates discipline and responsibility. It inspires you to spend with thoughtfulness and take charge of your financial situation. When you match your spending to your values and important things, it helps build a feeling of economic wellness. This allows for more contentment in the choices made about money matters.

- Financial Goals Alignment: Use your budget to align your spending with your financial goals and priorities. Whether it's saving for retirement, paying off debt, or funding a vacation, your budget can help you allocate resources accordingly.

- Behavioral Changes: Recognize that budgeting often requires changes in behavior and mindset. Be prepared to adjust your spending habits and make sacrifices to achieve your financial objectives.

Benefits of Budgeting

Budgeting is not only useful for handling daily expenditures but also helpful in decreasing anxiety and unpredictability related to finances. It gives you control over your money, allowing you to make thoughtful choices about where it goes, which supports progress toward future monetary goals. Moreover, budgeting assists in identifying places where you can decrease spending or raise savings, which eventually betters your monetary condition.

Additionally, budgeting gives you a feeling of being in charge and confident about your upcoming economic times. When you handle money actively, it builds up trust in your potential to accomplish financial triumphs. Budgeting promotes taking initiative for financial planning and equips you with skills to handle unforeseen difficulties or shifts in your monetary situations.

- Debt Management: Use your budget to prioritize debt repayment, allocating extra funds towards high-interest debts to accelerate your progress towards financial freedom.

- Financial Freedom: Recognize that budgeting is a tool for achieving financial freedom and independence. By taking control of your finances and making intentional decisions about your money, you can create a pathway to a secure and prosperous future.

Types of Budgets

A fixed budget sets a specific amount of money for each spending category. This type of budget provides constant amounts but gives less flexibility. On the other hand, a flexible budget adjusts spending according to changes in income or expenses. It allows more adaptability yet needs continuous observation and alteration.

Apart from fixed and flexible budgets, there exist unique budgeting techniques that focus on particular financial difficulties. An instance is zero-based budgeting which demands assigning all earnings to expenditures, savings, or settling debts; this leaves no space for unspecified spending. In the same way, envelope budgeting consists of breaking up cash into physical envelopes marked with different expense groups to limit optional expenditures and promote prioritization.

- Zero-Based Budgeting: Consider implementing a zero-based budgeting approach to ensure that every dollar has a designated purpose within your budget, maximizing efficiency and minimizing waste.

- Envelope Budgeting: Experiment with envelope budgeting as a tangible and visual method for managing discretionary spending, providing clear boundaries and accountability for your financial decisions.

Conclusion

To sum up, a budget is very important for managing personal money matters in a systematic and planned way. It helps you be in control of your spending habits, save more money regularly, pay all necessary bills on time, and achieve financial goals that are important to you. If you want to buy something big or have plans like going on vacation, building your dream house, or saving for retirement, having a budget will make sure these things happen smoothly without any stress about not having enough funds available at the right moment. In a general sense, making and following through with budgets makes life easier by providing clear paths towards our desires while keeping us safe from unexpected events along the journey.

-

Investment Nov 13, 2023

Investment Nov 13, 2023Paid vs. Free Real-Time Stock Charts

Real-time stock charts are available for 5-minute, 1-minute, and additional intraday charts time frames on various websites and platforms. A few of them even provide cost-free access to real-time stock tracking capabilities. Depending on your objectives, it can mean a lot to you.

-

Investment May 19, 2024

Investment May 19, 2024All About Data Analytics

Get the basics of data analytics, understand its wide range of uses, and how it creates useful information in different sectors.

-

Investment May 10, 2024

Investment May 10, 2024How Kansas City Life Insurance Stands Out: A Comprehensive Review

Explore the key benefits of Kansas City Life Insurance, from its exceptional customer service to its stable financial standing and diverse product portfolio.

-

Investment May 19, 2024

Investment May 19, 2024Financial Considerations of Renewable Resources

Explore the financial aspects of renewable resources, like explanations, main things to think about, and different kinds in this complete guide.