Explain in Detail: What Is Auto Insurance Bodily Injury Coverage?

Oct 26, 2023 By Susan Kelly

Introduction

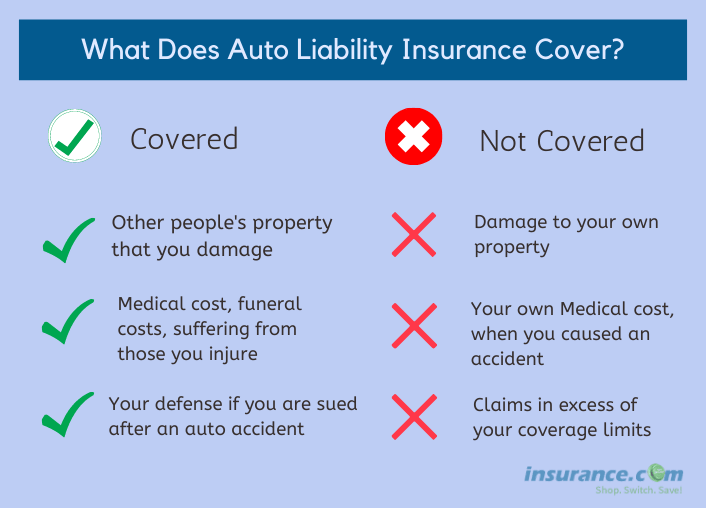

What is Auto Insurance Bodily Injury Coverage? If you're at fault in an auto accident that leaves another individual injured, bodily injury liability insurance will assist cover their medical bills and lost wages. If you are sued due to an accident, this insurance may also help with the costs of defending yourself in court. To drive legally in most places, you must have bodily harm liability coverage on your auto insurance policy. If you cause an accident and another driver suffers injuries. As a result, your physical injury liability insurance will cover those costs. It covers hospital bills, lost wages, and last expenses. The bodily injury will not pay for your medical bills, no matter how serious an event. Since it only covers damages to other people's vehicles and people in them (the "third-party"), it is called "third-party" insurance.

What Does Bodily Injury Liability Cover?

Liability for physical harm Accidents involving multiple vehicles can quickly rack up medical bills, lost wages, and other expenses you may be responsible for paying for under your bodily injury liability coverage. Insurance like this can help cover costs like hospital stays and urgent care visits. In addition, it will be used to offset the price of:

- If someone else is hurt in an accident and they have to miss work to receive treatment, this insurance can assist them in making up for their lost income. If someone gets hurt in an event, you're responsible for it and have to take time off work. As a result, their missed wages should be covered by your bodily injury liability policy.

- If you're at fault in an accident and the other motorist sues you, bodily injury liability insurance can assist cover the cost of defending your case in court.

- If you cause an accident and other people are hurt. As a result, pain and suffering coverage might assist pay for their medical bills.

- If an accident you cause results in the death of another person in that car, this insurance can help pay for their burial fees.

- Remember that medical payments coverage can help cover the costs associated with treating your injuries if you or anybody in your car gets hurt in an accident.

What Does Bodily Injury Liability Insurance Not Cover?

There are three primary expenses not covered by bodily injury liability insurance.

Your Medical Costs

When an accident occurs, bodily injury liability insurance pays for the medical bills of those injured. Depending on where you live, you may be able to purchase personal injury protection or medical payments (MedPay) coverage to help pay for any medical expenses you incur.

Property Damage

When you cause an accident, the other driver's car almost always suffers damage. Also, you run the risk of damaging someone else's fence, building, or store. Liability auto insurance's property damage coverage would pay for this.

Damage To Your Vehicle

Bodily injury liability policies do not cover auto repairs. You need collision insurance if you want to get reimbursed for vehicle repairs.

How Much Physical Harm Liability Insurance Do I Require?

You may be required to show proof that your vehicle's liability insurance meets a minimum state requirement when you register it. The minimum insurance coverage mandated by your state is likely not enough to protect you and your possessions from financial ruin.

What Distinguishes Physical Injury Responsibility From Property Damage Liability?

There are two types of liability coverage: bodily injury liability and property damage liability. In many jurisdictions, both policies are obligatory. If you cause damage to another person's vehicle or property, this insurance can assist cover the costs associated with fixing it. If your car causes injury to another person's property, such as their vehicle, mailbox, or porch, your property damage liability coverage may assist with the costs associated with such repairs. Also, similar to bodily injury liability, property damage liability is typically mandated by law in all but a handful of states. If you cause someone else's injuries in a car accident, bodily injury liability insurance might assist cover the costs. It is essential to keep in mind that this sort of insurance often serves to pay for the medical expenses of another person.

Conclusion

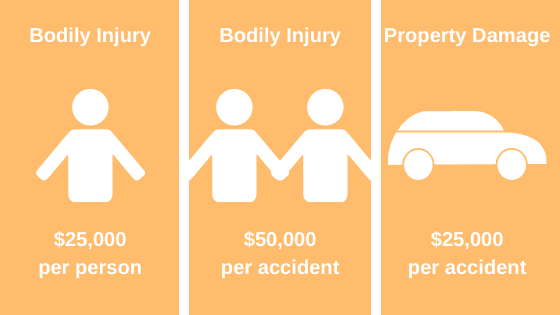

Your car insurance policy likely includes coverage for bodily injury and property damage liability. It can assist with the medical bills of anyone injured in an accident for which you are at fault. In other words, it's not meant to compensate the at-fault motorist (like you) but rather the victims of the accident who were riding in other vehicles. There are often two different caps on how much money will be paid out in the event of a bodily injury claim: one for each individual injured and another for the total number of people hurt in an accident. These restrictions are often presented as a three-digit numeric sequence, as in 15/30/15. The first two figures are your maximum bodily injury liability and property damage maximum.

-

Investment May 19, 2024

Investment May 19, 2024All About Data Analytics

Get the basics of data analytics, understand its wide range of uses, and how it creates useful information in different sectors.

-

Know-how Oct 26, 2023

Know-how Oct 26, 2023Explain in Detail: What Is Auto Insurance Bodily Injury Coverage?

Bodily damage liability insurance covers the cost of treating anyone injured due to an auto accident in which you were at fault (not including yourself). This insurance might help pay for your defense if you are sued for damages. If you drive in a state that requires auto insurance, you should be sure your policy includes bodily injury liability.

-

Know-how Nov 28, 2023

Know-how Nov 28, 2023Flexible Fuel Vehicles

Flexible fuel vehicles, often known as FFVs, are automobiles that can operate on either regular gasoline or a mixture of gasoline and ethanol that contains as much as 85 percent ethanol.

-

Know-how May 20, 2024

Know-how May 20, 2024Understanding Commercial Property Insurance: A Comprehensive Guide

An essential guide to securing your business with commercial property insurance, covering risk management, employee safety, and emerging insurance trends.