Understanding Credit Cards - A Comprehensive Guide

May 20, 2024 By Susan Kelly

Credit cards, a financial instrument that many people use to manage money and buy things, are very prevalent. They give convenience for users and can have many perks but it's important to comprehend how they function before utilizing them. In this article, we will take an in-depth view of what credit cards are, how they work as well as the process one needs to follow for acquiring such a card.

What Is a Credit Card?

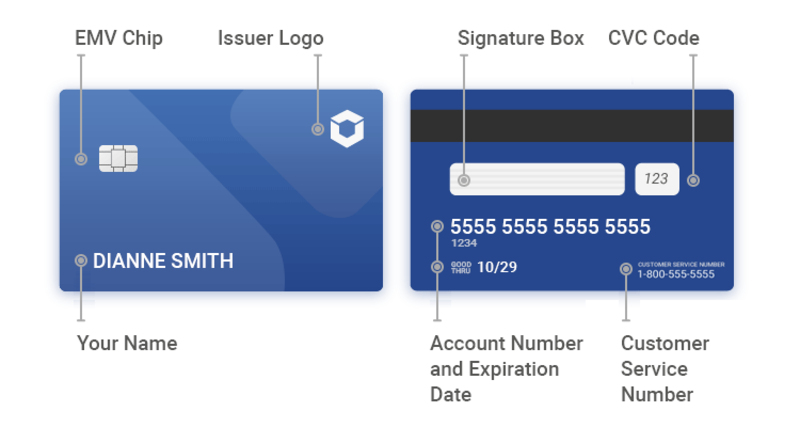

Credit card, it's a type of plastic or metal card given by a bank or other financial organization to someone that lets them borrow money for buying things and services. The person who uses this card agrees to return the borrowed funds as well as any interest charges according to conditions set forth by the issuer. Credit cards are different from debit cards because they remove money directly from your bank account. Credit cards provide a credit line that can be utilized, up to an assigned maximum limit determined by the card's issuer.

Credit cards are used widely nowadays because they offer ease and adaptability. Dissimilar to debit cards, which take money directly from your bank account, credit cards let you borrow funds to buy things now and return them later on. This postponed payment characteristic can be beneficial for handling cash flow and unforeseen costs.

- Credit Limits: Each credit card comes with a predetermined credit limit, indicating the maximum amount you can borrow. Exceeding this limit may incur penalties or declined transactions.

- Credit Scores: Responsible credit card usage can positively impact your credit score, making it easier to qualify for loans and mortgages in the future.

How do Credit Cards Work?

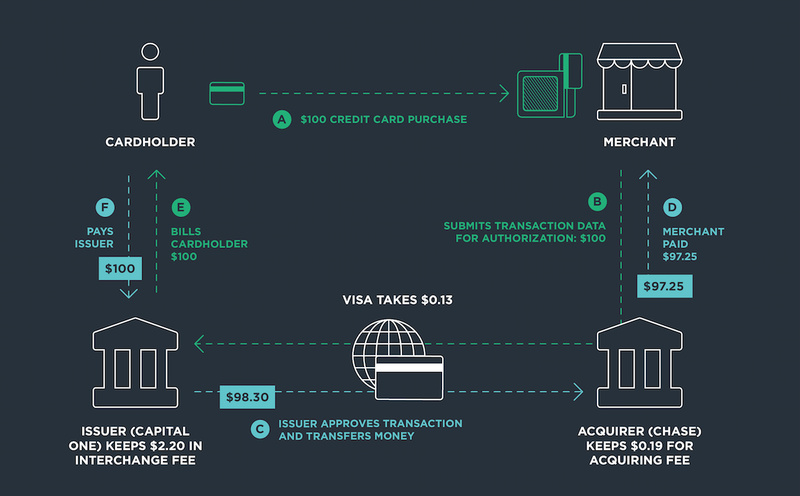

Credit cards work by giving a credit line to the person who holds the card. Whenever you use your credit card, it is similar to borrowing money from the issuer of that specific card. Every purchase made on your credit card decreases the amount of available credit you have, and usually, a part of the borrowed sum should be paid back monthly. If you don't pay the full balance, interest is added to what remains. The rate of interest, also known as the Annual Percentage Rate (APR), may differ depending on which card and issuer you use. Making payments on time can assist in creating a good credit record while late payments have potential harm to your credit score.

Knowing what minimum payments are is very important in credit card management. Even though you need to pay a certain minimum sum every month, it's recommended that you pay more whenever feasible to lower interest costs and settle the balance earlier.

- Grace Period: Many credit cards offer a grace period during which no interest is charged on purchases if the balance is paid in full by the due date.

- Credit Utilization: Keeping your credit utilization ratio low, by using only a small portion of your available credit, can positively impact your credit score.

Benefits of Using a Credit Card

Using credit cards comes with many advantages. They are handy for shopping online, making travel reservations, or regular buys without requiring physical money. Quite a few credit cards provide reward plans like giving back cash, travel points, and special discounts on certain purchases. Moreover, you get safety measures like anti-fraud protection and zero-liability policies with credit cards. They ensure that you aren't held accountable for any unauthorized transactions made on your card. Also, using a credit card to build a good credit history can assist in qualifying for loans and getting improved interest rates later on.

Being responsible for credit card use can give added advantages aside from rewards programs. Certain cards offer longer guarantees on items, safeguards for purchases, and insurance for travel that can make your buys more valuable and give you a sense of security.

- Rewards Redemption: Understand the redemption options for your credit card rewards, whether it's cashback, travel rewards, or merchandise, to maximize their value.

- Introductory Offers: Many credit cards come with introductory offers, such as 0% APR for a limited time or bonus rewards for new cardholders.

Understanding Credit Card Terms and Fees

It's very important to comprehend the conditions and charges related to a credit card before submitting your application. Essential terms are APR (Annual Percentage Rate), which signifies the interest rate on unsettled amounts; credit limit, which indicates the maximum sum you can borrow; fees like yearly charges, penalties for late payments, costs linked to transferring balances from other cards or accounts onto this one and finally expenses for conducting transactions abroad. Knowing these words could assist you in selecting a card that suits your financial requirements and preventing extra expenses.

Understanding the precise terminology and expenses linked with credit cards can assist you in making knowledgeable choices and preventing unexpected situations later on. Being mindful of the details and contrasting offers from various issuers might save you cash, as well as guarantee that you choose the perfect card for your money situation.

- Foreign Transaction Fees: When using your credit card abroad, be aware of foreign transaction fees, which can add up quickly. Look for cards that offer no foreign transaction fees if you frequently travel internationally.

- Introductory APR: Some credit cards offer introductory APR periods with low or 0% interest rates for a specified period, allowing you to save money on interest charges.

The Credit Card Application Process

To apply for a credit card, you need to complete a few steps. Begin by investigating different credit card options. Choose one that aligns with your spending habits and financial objectives, considering elements such as rewards schemes, interest charges, and any applicable costs. After you choose a card, the next step is to fill out an application. This usually asks for personal details like your name, where you live, social security number, and how much money you make per year. The company that gives out the card will look at your credit history and other financial info to decide if they can give it to you or not. If they say yes, then soon after that a credit card will come in the mail for you along with all the rules about how this account works called "terms and conditions".

To successfully apply for a credit card, you need to pay attention to details and think about your financial situation carefully. By giving correct information and knowing what affects the approval of credit cards, you can improve your chances of success in getting one.

- Credit Inquiries: Each credit card application results in a hard inquiry on your credit report, which can temporarily lower your credit score. Apply for cards selectively to minimize the impact on your credit.

- Prequalification: Some issuers offer prequalification tools that allow you to check your eligibility for a credit card without affecting your credit score.

Managing Your Credit Card Responsibly

After acquiring a credit card, it is crucial to handle it responsibly to prevent debt and keep up a favorable credit rating. Always make payments on time so as not to incur late payment charges or interest penalties. Attempt to pay your entire balance every month, which will help you avoid carrying any debt over from one month into another. Keep checking your account often for any transactions not authorized by you and inform about them right away. It is good to maintain low credit utilization, this means using only a small part of your available credit which can help improve the score on your credit. Using a credit card with responsibility might create flexibility in managing finances and better overall financial condition.

Looking at your credit card statements often and keeping track of what you spend can assist in managing your money well. It aids in spotting any differences or unapproved fees that may be present. You can set up notifications for payment deadlines and account actions too, which are beneficial methods to handle your credit card efficiently..

- Credit Card Benefits: Explore the additional benefits offered by your credit card, such as purchase protection, extended warranties, and travel insurance, to maximize its value.

- Credit Counseling: If you find yourself struggling with credit card debt, consider seeking credit counseling services to help you develop a repayment plan and improve your financial habits.

Conclusion

To sum up, credit cards are a helpful financial resource that provides ease if used with care, rewards, and chances for creating a good credit background. Learning about these cards' functioning, the advantages they give, and the terms and charges associated with them along with the application method are important parts of managing your money efficiently. This full guide wants to give you the understanding needed for making wise choices regarding the use of credit cards.

-

Investment Feb 05, 2024

Investment Feb 05, 2024The Best Debt Relief Programs in 2024: An In-Depth Comparison

Compare the best debt relief programs in 2024. Insights into options and services.

-

Mortgages May 20, 2024

Mortgages May 20, 2024Understanding Budgets

Understand the basics of budgeting, its purpose in organizing finances, controlling expenses and maximizing resources for stability.

-

Know-how Nov 25, 2023

Know-how Nov 25, 2023What Is The Minimum Income to File Taxes

Learn what the minimum income is to file taxes, as well as any special circumstances or credits and deductions that you can use for maximum savings. Discover everything you need to know about filing your taxes here!

-

Taxes May 19, 2024

Taxes May 19, 2024Foreign Direct Investment (FDI): Definition, Types, And Pros and Cons.

Learn about Foreign Direct Investments in this article: what they are, its types, benefits, and drawbacks.