How To Choose Personal Finance Software

Dec 07, 2023 By Susan Kelly

This list of features and benefits will help you understand what you need in your software, If you are new to the concept of personal finance software and are curious about the benefits of better money management, or whether you are considering switching from one application of the same kind to another, this article can help.

Financial Management Tools For The Individual?

Key elements of financial planning are included in personal finance software and should be evaluated and monitored consistently. Personal finance software helps with financial planning in three ways: assessment, plan preparation, and monitoring and reevaluation.

Finance Applications And Apps

Choices are available in a large number. We will be focusing on the most comprehensive personal finance software.

Budgeting:

Spending can be monitored and organized with the use of budget software and mobile apps. The software may automatically classify your expenditures when you link your bank, savings, credit card, loan, and investment accounts.

Savings:

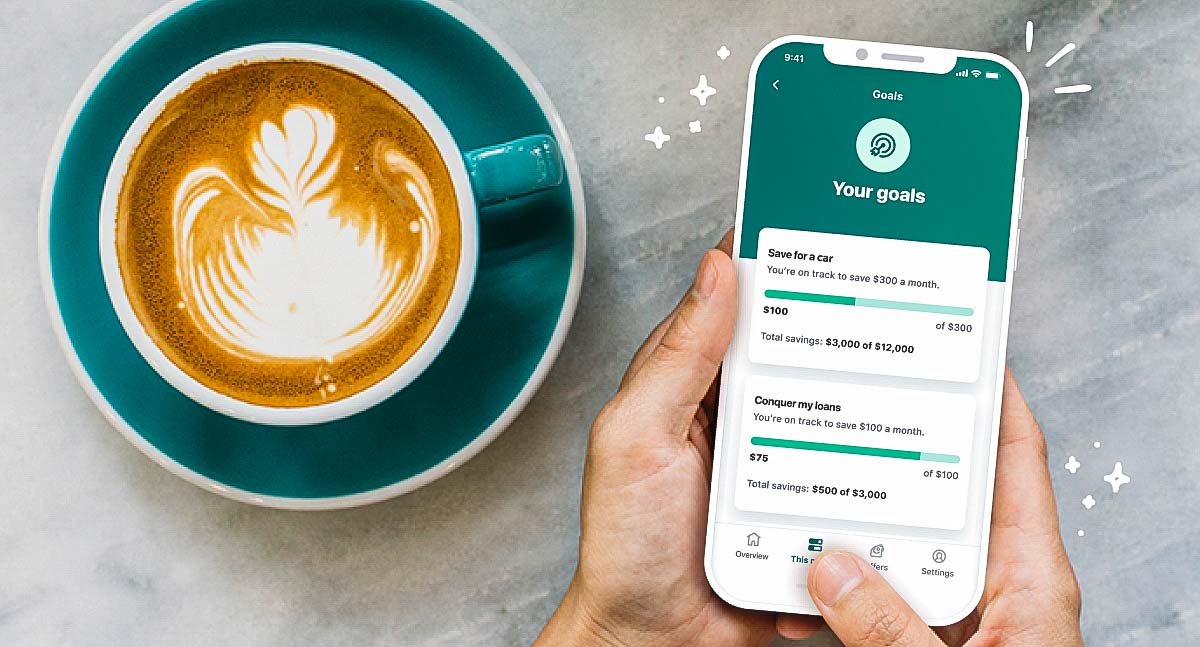

The use of software and apps has made monthly savings easy. To help you save without even thinking about it, several services may send money to your savings account or a designated account.

Investment:

Investments put your money to work for your long-term goals, like retirement, but they may be intimidating for novices and seasoned investors alike. The right portfolio-building tool and the trading app can make all the difference in the world.

Taxes:

Tax preparation software streamlines the process of completing and submitting your tax return. Most programs will ask simple questions and walk you through common deductions to help you make sense of the IRS's complex tax code.

Why Use Personal Finance Software?

There will be no missed payments, account reconciliation will be a breeze, budgeting, and tax preparation will be a breeze, bills can be paid online, investments can be tracked and analyzed, expenditure comparisons can be made in a flash, and money mistakes can be avoided, credit scores can be monitored, and new financial goals can be set and tracked with ease all thanks to personal finance software.

How To Choose Finance Software?

Because of the wide variety of available options, picking out and acquiring personal finance software can be time-consuming. Here are some things to think about before buying a piece of personal financial software:

Connectivity:

It needs to be able to communicate with various bank accounts.

Budget-Saving Tools:

Time-saving budgeting features, such as the ability to set automatic payments, are essential.

Maintaining A Budget:

It should keep track of your remaining funds and allow you to set up notifications for when certain thresholds are crossed.

Incorporation Of Mobile Technology:

It needs to be compatible with mobile platforms like Android and iOS.

Security:

Be able to give security on par with a bank.

How To Evaluate A Budgeting App

Prioritize your needs, the features you want, and the level of sophistication you're comfortable with when deciding on personal financial software. Look for a budgeting program that connects with your bank and credit card accounts if you need an app that monitors your spending and income.

Cost:

When managing your money, you may have the option of using a free version or paying a monthly, annual, or one-time price for access to a more robust premium edition of the service.

Restrictions On The Account:

Some programs only allow you to use a certain kind of account, or they limit the number of accounts you can create. If you need to keep tabs on multiple accounts, such as a bank account, credit card, and investment portfolio, then you should look for a service that can do so.

Accounts Of Expenditures:

Choose a program that graphically displays your spending habits by category or amount. If the reports can be tailored to your specific financial objectives, that's a plus.

Free Credit Report:

Credit monitoring tools update your score weekly or monthly, as well as credit decision simulators that can help you see how certain financial moves might affect your score.

What Are Financial Best Software Options?

You may learn the fundamentals, improve your efficiency, and find new paths to your financial goals with the help of personal finance tools and apps. Your existing financial situation should guide your choice of personal finance software.

Budgeting and cost monitoring are just two of the many tasks that can be simplified with the help of personal finance software. It would help to consider how much you can allocate to personal financial management software.

Best Finance Software Of 2022

Quicken

When it comes to budgeting and tracking personal finances, Quicken is a tried-and-true option. The software may help you with various financial tasks, including budgeting, debt management, saving, and investing guidance. It also exports to Excel, so you may change and calculate with your data in Excel.

Mint

The program can be instructed to access your banking and credit card records to thoroughly examine your spending habits and highlight areas where reductions in outlay would have the greatest impact on your financial situation.

-

Mortgages May 20, 2024

Mortgages May 20, 2024Understanding Credit Cards - A Comprehensive Guide

Understand the definition of a credit card, its role as a money management tool, and the stages for applying for one.

-

Investment May 13, 2024

Investment May 13, 2024Deciphering Public Offerings: Direct Listings versus IPOs

Explore the differences, advantages of direct listings and IPOs in capital markets for informed investment decisions.

-

Know-how May 19, 2024

Know-how May 19, 2024Decoding Adjusted Premiums: A Comprehensive Guide

Explore the impact of big data and predictive analytics on insurance premiums, the ethical considerations, and the role of regulatory oversight in the industry.

-

Investment May 19, 2024

Investment May 19, 2024All About Data Analytics

Get the basics of data analytics, understand its wide range of uses, and how it creates useful information in different sectors.