Essential Tools for Stock Evaluation

May 19, 2024 By Triston Martin

In the world of stock market investing, it is very important to evaluate the value and potential of a stock for making wise decisions. Two major metrics that investors usually consider are the Price to Earnings (P/E) Ratio, as well as the Price/Earnings to Growth (PEG) Ratio. These tools give an idea about how much a company is worth and its chances for growth. This helps investors decide if they think a stock might be too pricey, cheap, or just right in terms of value compared with future earnings growth prospects. This article is about the basic ideas, advantages, and restrictions of these ratios. It also talks about how to use them in stock assessment.

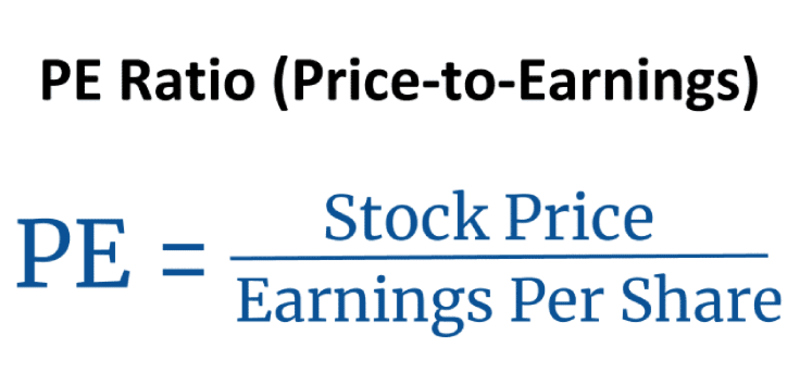

Understanding the Price-to-Earnings Ratio

The Price to Earnings (P/E) Ratio, is a metric that many investors use for understanding the market worth of a stock about how much profit the company makes. This one can be found by dividing the current stock's market price by its earnings per share (EPS). The P/E ratio shows what amount investors are ready to give up for each dollar earned and gives an instant view of the stock's value.

A big P/E ratio could mean the stock is too pricey because investors are eager to pay a high price for its earnings. On the other hand, if the P/E ratio is low it might signal that this stock is cheaply priced and possibly a good deal. Yet, it's crucial to compare the P/E ratio with industry norms and past values for better understanding as different sectors have their own typical P/E ranges.

- Consideration: Compare P/E ratios within the same industry for better context.

- Fact: Historical P/E ratios can provide insight into a stocks valuation trends.

Limitations of the Price to Earnings Ratio

The P/E ratio is a helpful method, but it also has its set of drawbacks. The most important one is that it doesn't consider future growth possibilities. A company with a high P/E might show strong earning chances in the future, which makes the premium price reasonable. Also, the P/E ratio might be distorted by singular earnings events like asset sales or unusual costs, that may not show the continuous performance of a firm.

Another limitation is that the P/E ratio does not give any hints about the company's capital structure. Companies that have high levels of debt may show earnings that are artificially elevated because of lower interest costs, thus inflating their P/E ratios. In this way also, it becomes very important to use the P/E ratio with other financial measures and analysis for a complete assessment.

- Consideration: Adjust for one-time events to avoid distorted P/E ratios.

- Caution: High debt levels can skew the P/E ratio, masking financial health.

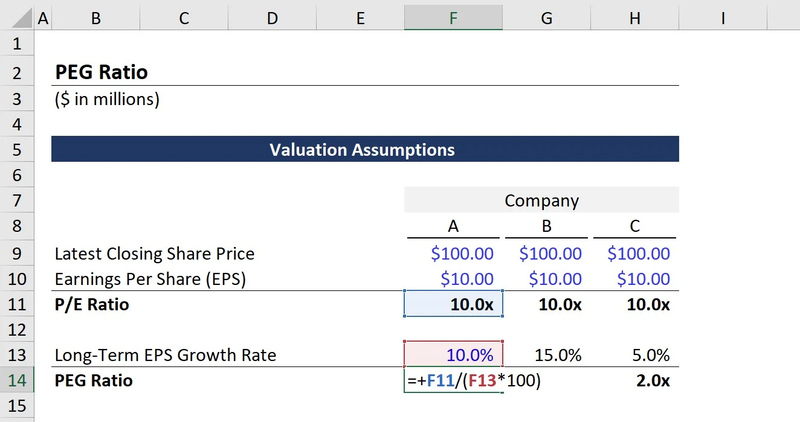

Introduction to the PEG Ratio

The Price/Earnings to Growth (PEG) Ratio overcomes some of the challenges of the P/E ratio by including a company's earnings growth rate in its valuation. The formula for this ratio is dividing the P/E ratio by the yearly earnings growth rate. The PEG ratio offers a fairer perspective on how valuable a stock is, as it takes into account both existing earnings and predicted expansion.

A PEG ratio equal to 1 is usually seen as a fair value, showing that the stock's price matches up with its growth potential. If the PEG ratio goes over 1, this could mean the stock is possibly too expensive; alternatively, if it falls below 1 then there might be an undervaluation happening. When you consider growth along with price about earnings (P/E), it gives investors more insight into which stocks may be underpriced even when they have high P/E ratios.

- Fact: A PEG ratio below 1 often signals undervaluation.

- Consideration: Use the PEG ratio alongside other growth indicators.

Benefits of the PEG Ratio

The PEG ratio does better than the old P/E ratio in certain ways. One, it gives a more all-around evaluation of stock worth by considering expected growth. This characteristic makes the PEG ratio especially helpful when assessing growth stocks, which could show high P/E ratios because of their good future earnings possibilities.

Also, the PEG ratio is useful for comparing companies in various industries with different rates of growth. It helps to standardize the valuation relative to growth and allows for better comparisons between companies with varying growth paths.

- Benefit: Useful for comparing high-growth companies.

- Fact: PEG standardizes valuation, aiding cross-industry comparisons.

Limitations of the PEG Ratio

Just like any method for evaluating investment quality, the PEG ratio also has its drawbacks. One main challenge is that it depends on precise and dependable growth estimates. It can be tough to accurately guess how much a company's earnings will increase in the future, and this often gets affected by many outside elements such as market situations, rivalry among businesses, and economic patterns. Inaccurate growth estimates can lead to misleading PEG ratios.

Additionally, the PEG ratio could be affected by the quality of earnings growth. If the growth is because of temporary events or aggressive accounting methods, it might make this ratio look higher than what it truly is. Those who use the PEG ratio to evaluate stocks, need to carefully check on the origin and durability of their earnings growth.

- Caution: Be wary of overly optimistic growth projections.

- Fact: Sustainable growth is key for an accurate PEG ratio.

Practical Application of P/E and PEG Ratios

To use the P/E and PEG ratios in stock assessment, you should think about some practical steps. First, examine historical P/E and PEG ratios for the stock and compare them with industry standards. This past viewpoint assists in recognizing patterns as well as determining if the stock's present appraisal is reasonable.

Secondly, investors must assess the company's potential for growth and how dependable these growth forecasts are. This involves examining elements like market standing, competitive edges, the caliber of management, and trends in the industry. When you have a good comprehension of these aspects it can improve precision when estimating growth rates that will be used within PEG ratio calculations.

- Consideration: Cross-check growth projections with industry trends.

- Fact: Historical ratios provide valuable context for valuation analysis.

Conclusion

To sum up, the P/E and PEG ratios are useful for evaluating how much a stock is worth and its possible growth. Every ratio has its advantages and restrictions, but using them together with other financial measures plus qualitative analysis gives a stronger structure to make investment decisions. When people think about both present earnings as well as potential growth, they can choose better options to manage the complicated nature of stock markets.

-

Mortgages May 20, 2024

Mortgages May 20, 2024Understanding Credit Cards - A Comprehensive Guide

Understand the definition of a credit card, its role as a money management tool, and the stages for applying for one.

-

Mortgages May 20, 2024

Mortgages May 20, 2024Understanding Budgets

Understand the basics of budgeting, its purpose in organizing finances, controlling expenses and maximizing resources for stability.

-

Know-how Nov 03, 2023

Know-how Nov 03, 2023Short Term Car Lease

An arrangement you establish with a lessor to make payments on an automobile for a period that is no more than two years is known as a short-term car lease.

-

Know-how May 19, 2024

Know-how May 19, 2024Errors and Omissions Insurance Explained: Protecting Your Professional Practice

This article offers an in-depth guide on Understanding Errors and Omissions (E and O) insurance, including coverage specifics, choosing policies, and maintaining protection.